A Digital Contribution (a.k.a. Post-Visit measure) entails two phases. During the first phase, a customer visits a company site or contacts a call center and agrees to take a survey about that experience (typically a Browse/Site Management or Contact Center Sales/Service survey). Within the Custom Questions on that survey, they are invited to participate in a follow-up survey focusing on their actions after the initiating interaction with the company. If they agree, their email address is collected within the survey. Those who volunteered to participate in the follow-up are sent an email invitation from ForeSee allowing access to the second survey which focuses on their post-visit actions (e.g., made an online purchase, visited a store, purchased a competitor’s product).

Available in these channels:

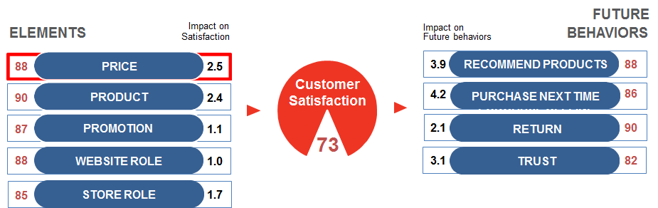

Marketing and customer experience leaders desire to know how effective their digital and customer care channels are at meeting customer expectations, and what things customers are seeking from those channels. To do so, they must gain an understanding of the customer’s reason for visiting and the actions they took after the interaction. However, this process is not easily observable. With this blind spot of the customer journey, leaders need to be able to discern how to improve their channels and the overall customer experience. Insights from Post-Visit include:

Both strategic marketing and customer experience teams require a link between a visitors’ digital or customer care experiences and what they did after that specific experience. They need to know if customers/prospects were able to carry out intended actions (e.g., purchase a product in a store after they researched it online).

A company that specializes in outdoor work apparel sells most of their merchandise through independent retailers, and does not receive much feedback on the availability of their product, or their customer’s ability to find it through a retailer. Their customers often use the company site for product research and then shop in an independent retail store, leaving the clothing manufacturer with no insight on the customer’s ultimate behavior. Through the use of a Post-Visit Measure, the company discovered that a majority of their retailers were not carrying the same products as were displayed online, so customers would choose a similar competitive product that was available at the retailer. After receiving ForeSee insights, the clothing company understood which products had the highest demand which could influence supply decisions to better equip their retailers with an optimal merchandise mix.

An outdoor power equipment company showcased and displayed their products online, yet did not sell them directly to end-users/consumers. Instead, they provided links to retailers who sell their products through physical locations. The company wanted to understand who was coming to their site, what their goals were, and how satisfied they were with the experience. ForeSee revealed that over half of the visitors came to the site with the intent to research and make a purchase, but did not follow through in their purchase. They cited lack of product photos, difficulty finding items and poor item descriptions as reasons for not purchasing. The client also realized people were leaving their site in a dissatisfied manner after conducting their product research. To address some of the key impacts influencing their customers’ experiences, ForeSee recommended improving navigation, updating product descriptions, and including better photos on their website to increase satisfaction and the potential for future purchases.

For more info on CPPs as well as a list of our default CPPs, please click here.

To access Post-Visit model templates, please click here.

The following touchpoints, when paired with a Post-Visit measure, have been shown to enhance the breadth, width, and scope of the solution ForeSee offers: